Getting My Offshore Business Formation To Work

Table of ContentsOffshore Business Formation - QuestionsNot known Details About Offshore Business Formation Excitement About Offshore Business FormationExcitement About Offshore Business FormationThe Basic Principles Of Offshore Business Formation More About Offshore Business FormationUnknown Facts About Offshore Business FormationMore About Offshore Business FormationThe Offshore Business Formation Ideas

If you registered a business in Hong Kong, its income would only be strained from 8. The earnings that is gained outside of Hong Kong can be completely excused from regional tax obligation. Apple, Samsung, Google, Berkshire Hathaway, they all have developed overseas business as their subsidiaries in many nations all over the globe.

The Buzz on Offshore Business Formation

Some countries impose unbelievably high tax obligation prices on company income. 5% in Puerto Rico, 30% in Germany, as well as 25% in France That's why thousands of entrepreneurs out there have made a decision to go offshore.

Tax optimization does not necessarily indicate to escape taxes. When seeking tax obligation options, you should comply with both the laws in the bundled territory and your home country.

Not known Incorrect Statements About Offshore Business Formation

They are starting to impose tax obligations as well as policies on particular kinds of revenue as well as business activities. As well as some places have a truly bad reputation in the company world.

In specific, banks in Singapore or Hong Kong are very concerned about opening up a make up business in tax havens. The same goes with clients and clients. They would certainly also be worried to do service with your firm if it is included in such jurisdictions. The stress certainly gets on choosing the ideal location.

Not known Factual Statements About Offshore Business Formation

That's why complete preparation and research is a have to (or at least the right examination from the genuine professionals). Example Right here is an example for overseas planning: You open a business in the British Virgin Islands (BVI) to supply services overseas. You likewise develop your firm's administration in another country to make it not a BVI-resident for tax functions.

And considering that BVI has a reasonable reputation, you can open up a corporate savings account in Singapore. This will allow your firm to receive cash from consumers with simplicity. If needed, you after that require to develop your tax obligation residency in an additional nation where you can receive your service cash without being taxed.

A Biased View of Offshore Business Formation

This indicates only the income generated from within these nations goes through tax obligation (while foreign-sourced revenue is not). These nations normally have a network of international tax obligation treaties, which can bring you tax decrease and also exemption. These are a huge plus besides their minimal tax prices. So, if you accept paying a percentage of tax in return for respect and security, low-tax jurisdictions can be the right option.

This suggests, your assets are secured versus the judgment made by foreign courts. Only the court of the incorporation jurisdiction can position a judgment on the properties. If you formed a trust fund in Belize, the trust fund's property would be shielded from any kind of claim according to the regulation of another territory.

Some Ideas on Offshore Business Formation You Need To Know

Some other usual overseas centers that use monetary personal privacy are the BVI, Seychelles, Cayman Islands, and Nevis. The overseas unification procedure is instead basic and also rapid.

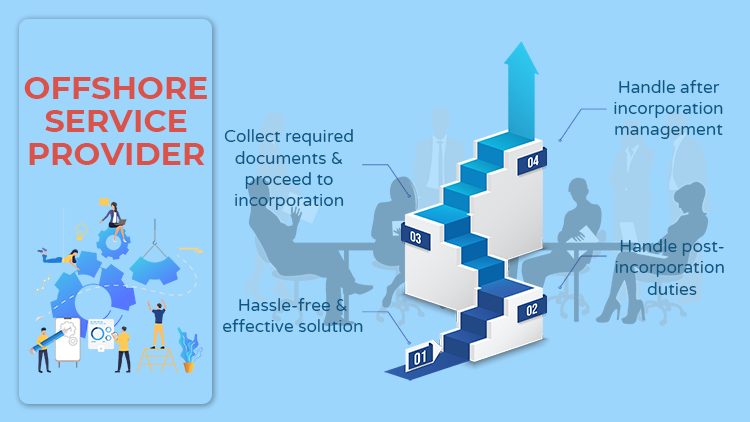

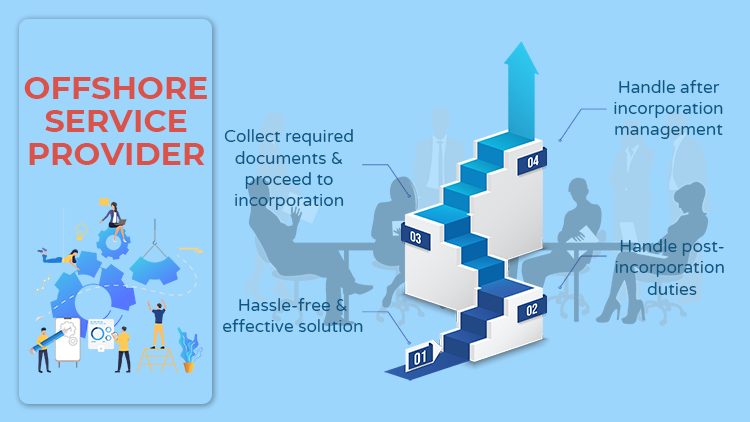

The incorporation needs are normally very marginal. The very best thing is that numerous provider around can assist you with the registration. All you need to do is find a credible provider, spend for service, and supply required documents. They will certainly go on and sign up the firm in your place.

See This Report about Offshore Business Formation

: Located in the western Caribbean Sea, this is a really typical selection for a lot of international capitalists that are looking for tax-free benefits.: BVI as well as Cayman Islands share numerous usual attributes - offshore business formation. However a plus is that the incorporation cost in the BVI has a tendency to be a lot more inexpensive than that in the Cayman Islands.

There are lots of various types of company entities. When selecting your type of entity, you should think about the adhering to elements: The entity special info lawful status The obligation This Site of the entity The tax obligation and also other advantages of the entity Suggestion, The guidance is to go for the type of company that has a separate lawful status.

Some Ideas on Offshore Business Formation You Should Know

A different legal entity assurances you a high level of security. That claimed, there are still cases where you might discover that a collaboration or various other unique frameworks are much more advantageous. And also everything depends upon your details situation. Each territory has a different collection of demands and unification process.

The 5-Minute Rule for Offshore Business Formation

The reason is that foreigners do not have details devices and accounts to register on their very own. Also when it is not required, you are still recommended to utilize a consolidation solution.